Digital Transformation in Restaurants: Embracing Contactless Payments

The Future of Dining is Digital

Contactless payments, which gained widespread traction in the restaurant industry during the pandemic, are now a consumer expectation. By 2021, a survey conducted by the James Beard Foundation found that 71% of diners wanted restaurants to continue offering contactless pay, ordering, or menus.1 Two years later, a 2023 report from McKinsey & Company found that more than nine out of 10 consumers reported using some form of digital payment over the course of the year—a metric which had grown steadily over the survey's eight years, accelerating during the pandemic lockdowns.2

These findings indicate that people appreciate the convenience and efficiency that contactless payments bring to their dining experiences, and that restauranteurs have embraced the capabilities of digital payments to optimize operations and help them reach more customers. This provides payment enablers an opportunity to help restauranteurs ensure they are meeting their customers’ expectations with contactless payment methods that not only satisfy diners’ desires for efficiency, but also their standards for security.

Digital transformation in dining is underway

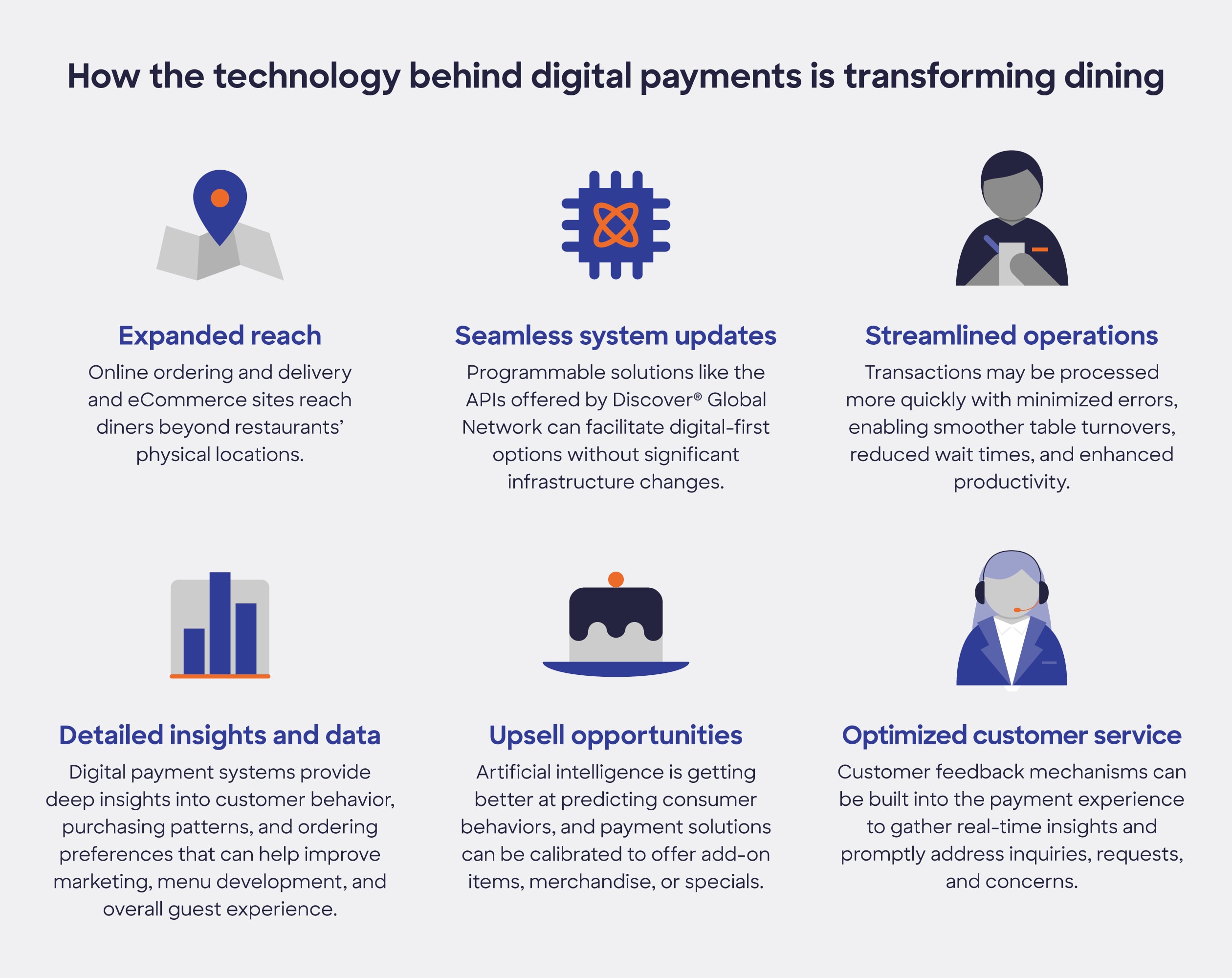

Restauranteurs are using digital payment solutions such as contactless payments, tap on mobile (ToM), QR codes, and online eCommerce platforms to help optimize their operations. When balanced with the right mix of face-to-face service and high-quality menu items, these innovations can help to exceed diners’ expectations and strengthen business.

Security enables desired payment experiences

In the rapidly changing payments landscape, security is essential. As the restaurant industry shifts to new payment methods, restauranteurs will need digital payment solutions that provide advanced security features to protect them and their customers.

Discover Global Network offers restauranteurs and their technology partners a suite of leading-edge solutions for building security features into all aspects of their payment processes. These include:

- Discover® Tokenization: To help restauranteurs secure digital payments made in person and online, tokenization replaces a customer’s card number with a unique, merchant-specific replacement code called a token that can only be used by that specific dining establishment.

- ProtectBuy®: Restaurants can validate customer identity at the time of purchase and provide real-time required action for high-risk transactions by using ProtectBuy, the three-domain secure (3DS) customer authentication solution for online and in-app purchases from Discover Global Network. Flagged transactions trigger a one-time-use password that is sent to the cardholder in almost real-time to help ensure that a payment is not fraudulent.

Contactless payments are convenient and secure

Digital wallets, contactless cards, and other contactless payment solutions like those offered by Discover Global Network make it quick and easy for customers to pay. Plus, these technologies support more secure transactions with chip-based technologies such as EMV®* and near-field communication (NFC). Contactless payment solutions include:

- Tap on Mobile (ToM): Restaurants can streamline transactions by offering ToM acceptance via integration with one of Discover Global Network’s certified ToM providers. ToM is well-suited to the types of payments frequently made by diners during order pickups, deliveries, and bill payment at the table.

- D-PAS Connect: The evolution of the EMV-compliant platform from Discover Global Network supports payment security with updated data encryption. When both the terminal and the customer’s card support D-PAS Connect, restaurants can use it to build personalized customer experiences like special offers. And when issuers are also a part of the solution, e-receipts for customers with email addresses personalized on their cards can be sent directly to them at the completion of a payment.

Good digital partners serve custom solutions

Breakthrough technologies paired with customer expectations for seamlessness are poised to reshape dining experiences and fundamentally change the industry's landscape. In this era of rapid change, payment enablers can help restauranteurs ensure that they invest their resources in ways that will help them grow. These efforts can be aided by payment solutions like those offered by Discover Global Network, which are customizable to meet a business’s unique needs. For support and expertise in implementing restaurant-specific payment solutions, reach out to your Discover Global Network representative.

Download Article

* EMV® is a registered trademark in the U.S. and other countries and an unregistered trademark elsewhere. The EMV trademark is owned by EMVCo, LLC.

The information provided herein is sponsored by Discover® Global Network. It is intended for informational purposes, and is not intended as a substitute for professional advice.

1. Borden, Maggie. (2021, March 17). Half of Diners Are Ready to Eat Out at Least Once a Week. James Beard Foundation. Accessed 25 January 2024 from https://www.jamesbeard.org/blog/opentable-feb2021-survey.

2. Chen, Mahajan, Nadeau, and Varadarajan. (2023, October 20). Consumer digital payments: Already mainstream, increasingly embedded, still evolving. McKinsey & Company. Accessed 25 January 2024 from https://www.mckinsey.com/industries/financial-services/our-insights/banking-matters/consumer-digital-payments-already-mainstream-increasingly-embedded-still-evolving.